May 12, 2025

Currency Trends, Tax Migration & Market Shifts: Reflections on 2024

While 2025 is certainly having its “hold my beer” time in the limelight, it’s worth remembering that 2024 provided us with its own rollercoaster ride. The sheer speed of change in a Maga-Part-Two World makes it easy to forget that only 10 months ago Joe Biden was still an even-money bet to be calling the shots from the West Wing this morning. Talk about sliding door moments…

Away from the spectacular US presidential election run-in, 2024 was a year when markets were super-focused on the Fed and its strategy for bringing down interest rates from their post-Covid 15-year highs, having seemingly tamed the inflation beast. Stock markets embraced this “cheaper” money by showing some spectacular returns, while at the same time starting to pose questions around the multiples being used to justify such valuations.

And locally the Rand was never going to go by unnoticed. Pre-election concerns saw the ZAR.USD at 19.40, followed by GNU-fueled optimism driving us down to 17.00, before the final quarter of the year saw the USD buy into its own Maga-hype, pushing the Dollar index to two-year highs and causing the Rand-Dollar cross to close out the year at 18.90.

Investment Outflows

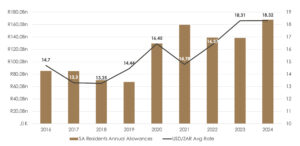

While the below chart doesn’t distinguish between the specific purposes of the allowances utilised by South African residents, these capital flows allow us our best guesstimate as to the trend in funds remitted offshore for investment purposes.

SA Residents Annual Allowances vs Average USD/ZAR (BOP 511 & 512)

Although we can see that 2024 showed a pick up in outflows under the categories of Single Discretionary and Foreign Capital Allowances (back to 2021 levels), it was very much a tale of two halves: a very busy first half of the year as apprehension ahead of our national elections saw clients hedge themselves by consistently externalising funds anywhere in the 18.00 – 19.00 range that had largely persisted since 2023, followed by a far quieter second half. Indeed, Currency Partners’ quietest period of last year included the months from August to November, where, ironically, the Rand enjoyed its longest consistent trading in the low 17.00’s since late 2022 / early 2023. While we can frequently characterise balking at relatively attractive levels as being due to complacency or greed, on this occasion it feels hard to level such a charge, given what transpired last year.

Many global share indices were trading at all-time highs, predictions regarding the outcome of the US elections were in a constant state of flux, Europe was struggling with sluggish growth and social issues, the UK had switched from Conservative to Labour rule and two significant regional wars were continuing. Meanwhile, in South Africa, a sense of (cautious) optimism had sprung up in the face of the formation of the GNU, giving rise to positive sentiment arguably not felt for the past 20 years – relatively speaking, the grass was looking pretty green. It was hard to blame people for sitting on their hands while seeing if the Rand could perhaps strengthen further.

Tax Migration

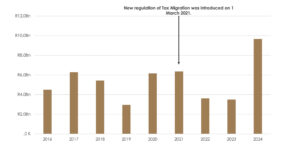

An interesting category, where we saw a 250% increase in outflows year on year (and an over 60% increase on the prior high of 2021), was in capital flows for emigration. We suspect that the bulk of this spike, following two years of declines, was largely due to the change in regulations regarding Tax Migration, introduced in March 2021. Specifically, the ability of individuals who have ceased to be resident for an uninterrupted period of 3 years or longer, to access the full benefits of their non-voluntary investments, would have suddenly made a large of amount of such capital available for externalisation during the course of 2024.

Capital Flows for Emigration (BOP 530)

Inheritance Flows

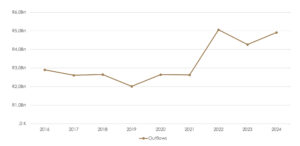

Currency Partners frequently assists beneficiaries of inheritances to remit their funds abroad, be it via their resident allowances or in their capacities as non-residents or emigrants. While the nominal quantum of these flows will always remain small within the context of cross-border flows out of or into South Africa, this category has doubled since a few years ago and should continue steadily in the coming years. Beneficiaries of all ages have remitted inheritances through us over the past few years and, given the ongoing migration of younger generations, will likely continue doing so.

As one would expect, we find that the longer an individual has been out of South Africa, the less rate sensitive they become. Those who left more recently and still have a link to the country – be it family and friends still living here, a sense of familiarity with the situation in SA or a general affiinity towards their previous home – are more likely to be patient in waiting for an “attractive rate”.

Inheritance Capital Outflows (BOP 409)

To speak to an expert, please contact us at enquiries@currencypartners.co.za or +27 21 203 0081. We look forward to hearing from you and saving you money on the exchange rates.

SPEAK TO AN EXPERT