October 01, 2025

Non-Resident Property Buyers: A Guide to Exchange Control and Tax

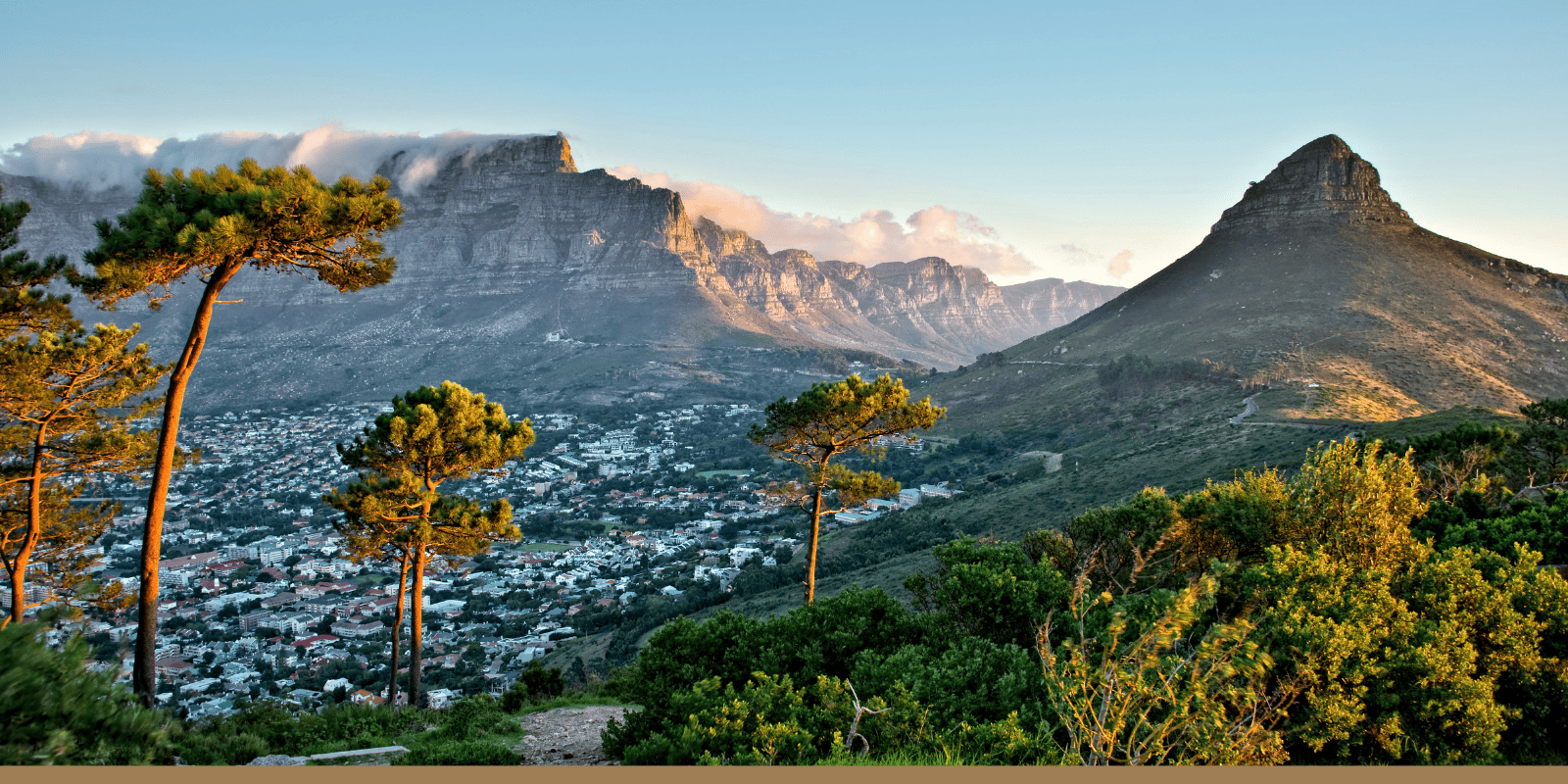

In 2025, South Africa continues to offer a compelling proposition for international property investors. The country’s diverse landscapes combined with its relatively affordable real estate market, make it an attractive destination for foreign buyers. Additionally, the easing of exchange control regulations has simplified the investment process for non-residents.

Who Qualifies as a Non-Resident?

A non-resident in South Africa is an individual or entity whose primary place of residence, domicile, or registration is outside the Common Monetary Area (South Africa, Namibia, Lesotho, and Eswatini). Foreigners can own property in South Africa either individually, jointly, or through entities such as companies, close corporations, or trusts.

Exchange Control Regulations

As of 2025, South Africa has relaxed its exchange control regulations. Non-residents can now invest in South African property without the need for prior approval from the South African Reserve Bank (SARB), provided the transaction is conducted at arm’s length and at fair market-related prices. Funds introduced into South Africa for property acquisitions must be supported by appropriate documentary evidence to ensure compliance with these regulations.

Furthermore, any money that a non-resident brings into South Africa to buy property can be sent back overseas later, along with any profit made from selling the property, as long as proof can be provided that the funds originally came from outside South Africa.

The same applies if the funds were used to buy shares or a member’s interest in a South African company that owns property. In those cases, the share certificates or ownership documents must be marked as “non-resident.”

If the purchase was financed through a foreign loan, the repayment and transfer of those funds abroad must follow the conditions that were originally approved by the South African Reserve Bank.

Income Tax

South Africa operates on a residence-based tax system. Non-residents are taxed only on income sourced within South Africa. Therefore, rental income derived from South African properties is subject to local income tax. Non-residents earning such income must register with the South African Revenue Service (SARS) and comply with local tax filing requirements.

Capital Gains Tax (CGT)

Non-residents are only liable to pay CGT on the disposal of the following:

- Immovable property situated in South Africa, including any right or interest in immovable property.

- Assets of a permanent establishment of a non-resident through which trade is carried on in South Africa.

CGT is payable in the year in which the asset is disposed of and is calculated by adding 40% of the capital gain or profit to the individual’s income for that year. The capital gain is calculated and disclosed in the individual’s income tax return for the year in which it is sold. Thus, if a non-resident disposes of an immovable property in any year of assessment and is not already registered as a South African taxpayer, he or she will have to register as such and submit an income tax return reflecting the calculation of the capital gain and will be liable for the payment of CGT on that gain.

The maximum effective rate of CGT is 18% of individuals, 22.4% for companies and 36% for trusts.

Withholding Tax on Property Sales

Although not a tax in and of itself, a withholding tax applies to non-resident sellers of immovable property. When a non-resident sells property in South Africa, the buyer is required to withhold a portion of the purchase price as an advance payment towards the seller’s potential tax liability. This withholding tax is applicable when the purchase price exceeds ZAR 2 million. The withholding tax rates are:

- 7.5% for non-resident individuals.

- 10% for non-resident companies.

- 15% for non-resident trusts.

The withheld amount is remitted to SARS and applied against the seller’s final tax liability. If the withheld amount exceeds the actual tax due, the excess is refunded to the seller. This legislation was created to avoid tax evasion.

Tax Compliance and Registration

Non-residents must be registered with SARS if they have taxable income or capital gains in South Africa. This registration is essential for fulfilling tax obligations and for the proper administration of withholding taxes. Failure to comply with registration and tax filing requirements can result in penalties and interest.

Navigating Property Ownership with Confidence

South Africa remains an attractive destination for non-residents seeking to invest in property. The relaxation of exchange control regulations has simplified the investment process, while clear tax obligations ensure transparency and compliance. Prospective investors should seek professional advice to navigate the complexities of property ownership and taxation in South Africa.

Whether you’re thinking of buying your dream home in South Africa or abroad, or simply need to make a foreign currency transfer, Currency Partners gives you access to the best pricing and service available in the market so you can make significant savings and enjoy the experience. To speak to an expert in our specialist team, email enquiries@currencypartners.co.za or call us on +27 21 203 0081.

SPEAK TO AN EXPERT