January 12, 2022

MyCURRENCY News | Week 3 2022

What we know

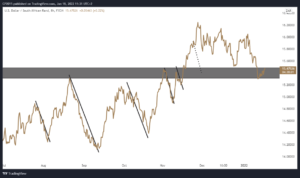

Not much unlike last year, the Rand has started the year off on the front foot. Which is a breath of fresh air after a rather tumultuous December which saw us bouncing fiercely between R16.30/USD and R15.67/USD. Volatility has been relieved into the 2nd week of January as market participants return to work and liquidity picks up. The question remains though, will the Rand be able to sustain itself at these levels?

January is set to close with a bang with the Fed interest rate decision falling on Wednesday, 26 January and our own MPC following the next afternoon. Both Reserve Banks are expected to raise by 25 basis points as the global economy starts to gear up for some type of return to normal. A shift from a pandemic to endemic classification by the WHO could really spur the progress on this front.

Domestic politics continue to play out in the background (thankfully) as ANC members jostle into position, hoping to secure stronger footholds ahead of their elective conference in December. It’s even easier to score cheap political points when there is an almost non-existent retort from the President.

Perhaps, after just short of 4 years, we would have learnt there is seldom a strong word to be said by the President, preferring to work his ways behind closed doors, or so we hope.

What others say

Financial Times – Short sellers need not fear transparency

“I am very much in favour of more short interest data [though] for granular transparency requirements, they should match long holding requirements. No reason for short sellers to be subject to more demanding requirements. The problem with GameStop [was] that hedge funds should not have taken a position with so high short interest. The data were stale but short interest would have been very high anyway. Updated market short interest data would not increase the risk of a short squeeze”.

Bloomberg – China cuts interest rate as growth risks worsen with Omicron

“Consumption remains the weakest link in China’s growth story at the moment and that will by and large continue for much of this year,” said Louis Kuijs, head of Asia economics at Oxford Economics. “We think Beijing has a bottom line of around 5%. As is the case at the moment, if growth is weaker than that, they’d feel strongly motivated to pursue more policy easing.”

Daily Maverick – Lindiwe Sisulu furore a microcosm of the battle lines being drawn in a fractured ANC

Is Sisulu building momentum around her presidential campaign? We all know that she has always had ambitions to be the president of the ANC and building up to the 2017 ANC National Conference she was one of the candidates for the position of president, although her name did not even go to the ballot as she did not have enough support.

Visual Capitalist – Prediction consensus: What the experts see coming in 2022

“Even at the best of times, it’s human nature to want to decode the future. During times of uncertainty though, we’re even more eager to predict what’s to come. To satisfy this demand, thousands of prognosticators share their views publicly as one year closes and another begins. In hindsight, we see varying levels of success at predicting the future.”

Financial Times – Moscow’s sanction-proofing efforts weaken western threats

The western sanctions under discussion could go far beyond those passed following Russia’s annexation of the Ukrainian peninsula of Crimea in 2014. They could ape punitive measures used against Iran and North Korea that all but cut the countries off from the global economy.

What we think

Any humble trader, as rare as they may be, would be wise to know their limitations when it comes to prophesizing the short-term future of any currency. These predictions may as well be accomplished by a stray coin toss. It is therefore sometimes important to remember where we have been in the past. For those taking money offshore or importing goods, this means remembering that since the end of November 2021, we have gained roughly 6%.

As the Rand feels out the R15.50/USD level, a move well below back down to the +-R15.30/USD should present a good buying opportunity though as it stands, we cannot justify a move much lower right now based on current market dynamics as the Rand remains at the mercy of international developments.

Our range for the week: R15.30 – R15.60.

Have a great week ahead.